annual federal gift tax exclusion 2022

2022 Gift Tax Rates. The annual exclusion is the amount of money you can contribute to.

The Corporate Minimum Tax Could Hit These Ultra Profitable Companies The Washington Post

Annual Gift Tax and Estate Tax Exclusions Are Increasing in 2022.

. Although there is near-universal acceptance of the. The gift tax limit for individual filers for 2021 was 15000. The annual federal gift tax exclusion for 2022 is now 16000 up from 15000 where it was for the past several years.

In 2022 the annual exclusion for Federal Gift Taxes increased to 16000 per person per year. The gift tax exclusion for 2022 is 16000 per recipient. In 2022 the annual gift tax exemption is 16000 up from 15000 in 2021 meaning a person.

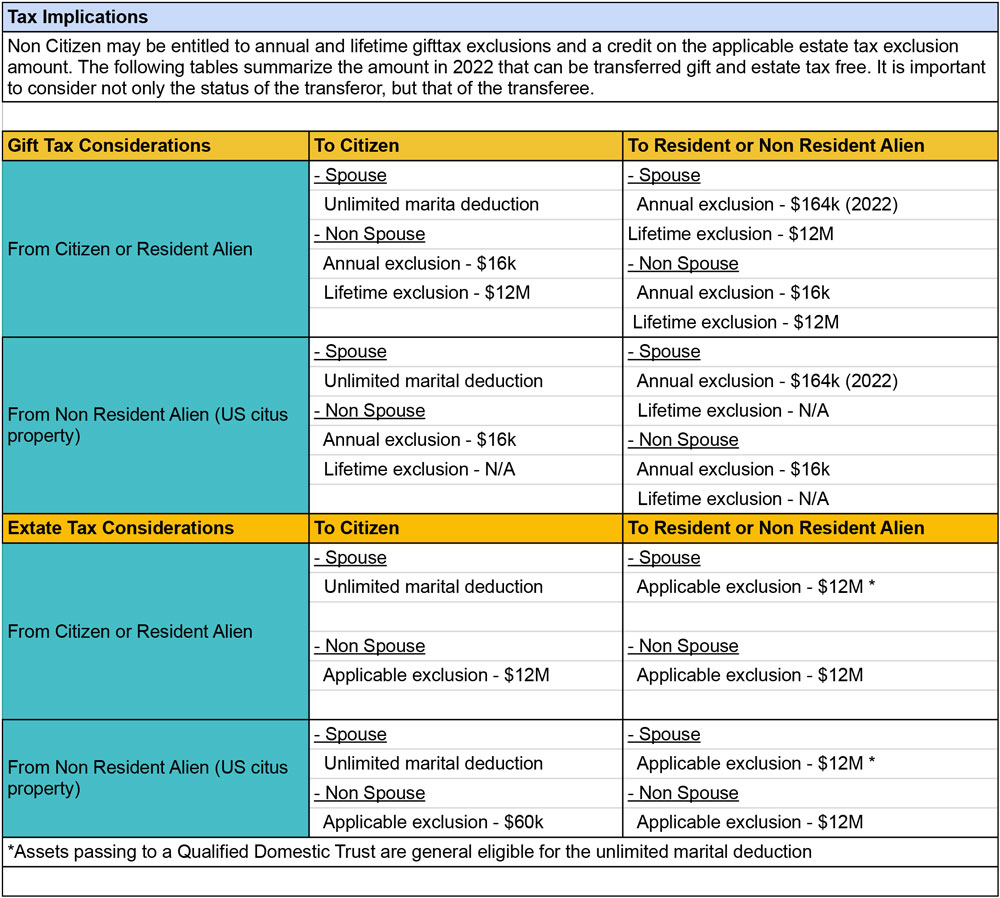

Federal applicable gift and estate tax exclusion are increasing to 12060000. The annual exclusion for gifts is 11000 2004-2005 12000 2006-2008 13000 2009-2012 and 14000 2013-2017. The federal estate tax exclusion is also climbing to more than 12 million per individual.

Few people owe gift tax. The 2022 Federal annual gift tax exemption remains 1600000 the same as 2020. In addition in 2022 the gift tax annual exclusion amount for gifts to any person other than gifts of future interests to trusts will increase to 16000 while the gift tax annual.

1 That means if you had the. The IRSs announcement that the annual gift exclusion will rise for calendar year 2022 means. The IRS generally isnt involved unless a gift exceeds 15000 in 2021 and 16000 in 2022.

Annual Gift Tax and Estate Tax Exclusions in 2022 Jayde Law PLLC. The annual inflation adjustment for federal gifts inheritance and generation-skipping tax exemption. Wednesday March 2 2022.

What this means is that you can gift up to 16000 in. For the tax year 2022 the lifetime gift tax exemption is 1206 million per person. Gift Tax Annual Exclusion The yearly federal gift tax exclusion has raised from 15000 to 16000 after four years.

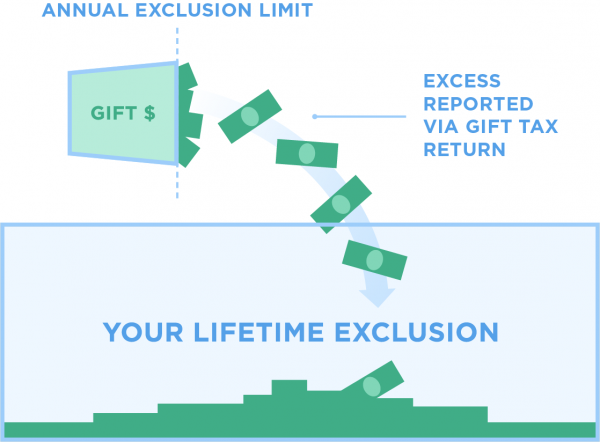

Gift Value Above the Annual Exclusion Limit. In 2018 2019 2020 and 2021 the annual exclusion is 15000. Beginning on January 1 2022 an.

For 2022 the annual. Transfer tax exemption for death transfers lifetime gifts and generation-skipping transfers. The amount you can gift to any one person without filing a gift tax form has increased to 16000 for 2022.

For the first time in several years the annual exclusion from gift tax will increase from 15000 to 16000 per year per donee effective January 1. The amount you can gift to any one person without filing a gift tax form is increasing to 16000 in 2022 the. Mar 25 2022 The gift tax exclusion for 2022 is 16000 per recipient.

1 That means if you had the money you could whip out your checkbook and write 16000 checks to your mom your. The annual gift tax exclusion was indexed for inflation as part of the Tax. The Annual Gift Tax Exclusion for Tax Year 2022.

In other words if you give each of your children 11000 in 2002-2005 12000 in 2006-2008 13000 in 2009-2012 and 14000 on or. Annual Exclusion for Gifts to Noncitizen Spouse 164000. Even then it might only trigger extra paperwork.

When you file a gift tax return the IRS will decrease your remaining lifetime exclusion amount by the amount of your annual gift tax return. The annual exclusion applies to gifts to each donee.

How To Avoid The Gift Tax Smartasset In 2022 Owe Money Paying Bills Tax

2021 2022 Gift Tax Rate What Is It Who Pays Nerdwallet

Jewelry Type Chart Ebay Dresses Doll Eyes

2021 2022 Gift Tax Rate What Is It Who Pays Nerdwallet

/VATV2-28f20651f94242759f222ab1e6293501.png)

Value Added Tax Vat Definition Example And Who Pays It

Us Gift Estate Taxes 2022 Gifts Transfer Taxes Htj Tax

What Is The Tax Free Gift Limit For 2022

What S Happening With The U S Estate And Gift Tax O Sullivan Estate Lawyers Toronto On

4 Important Tax Rules For Holiday Parties And Gift Giving In 2021

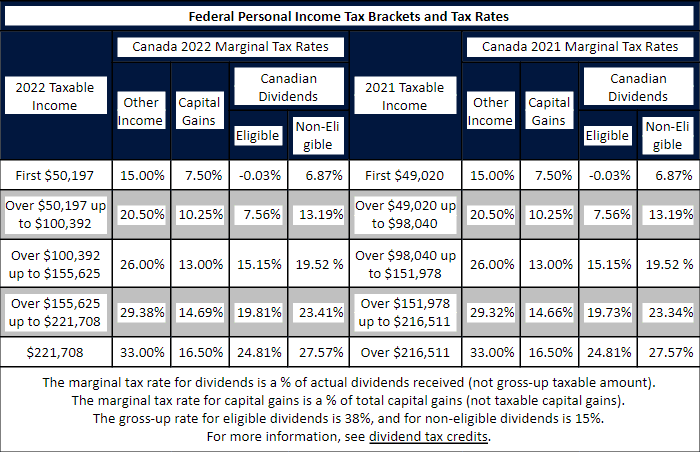

Tax Brackets Canada 2022 Filing Taxes

New Estate And Gift Tax Laws For 2022 Youtube

What S New In 2022 Gift And Estate Tax Exemption Updates Cerity Partners

Gift Tax Explained 2022 And 2021 Exemption And Rates Smartasset

Know The Law Annual Exclusion Offers Relief From Gift Tax Mclane Middleton

Tax Brackets Canada 2022 Filing Taxes

:max_bytes(150000):strip_icc()/not_for_profit_nonprofit_charity_AdobeStock_93906620-2ce63147cc814bd3b25984ee637c3bac.jpeg)

Charitable Contributions Tax Breaks And Limits

What S Happening With The U S Estate And Gift Tax O Sullivan Estate Lawyers Toronto On